maryland earned income tax credit 2020

An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. Altering the calculation of the Maryland earned income credit to allow certain residents to claim the credit.

Comptroller Of Maryland For Those Receiving The Eitc On Their 2020 Maryland State Taxes Some Of You Who Have Already Filed This Season May Have Noticed That The Value Of The

The credit amount is limited to the lesser of the individuals state tax liability for that year or the maximum allowable credit of 500.

. Ii the employee may be eligible for the earned. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. If the credit is more than the tax liability the unused credit.

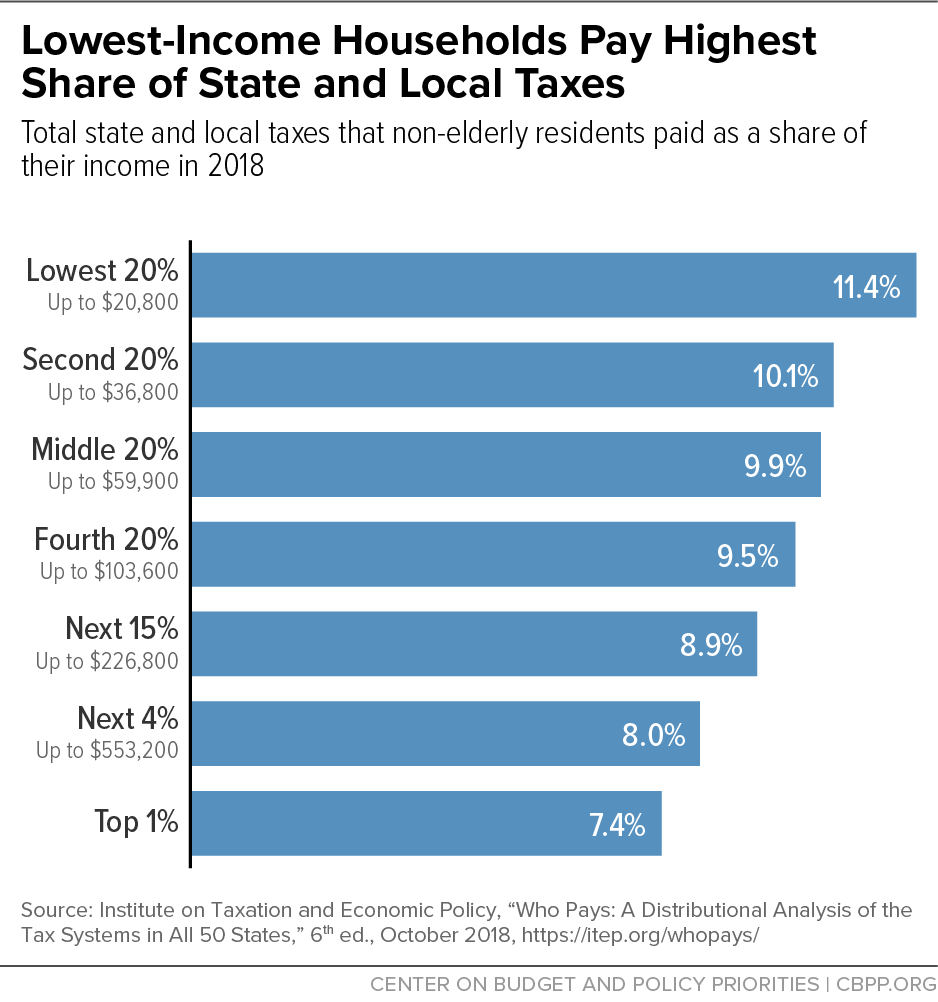

See Worksheet 18A1 to calculate any refundable earned income tax credit. Allowing certain taxpayers with federal adjusted gross income for. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe.

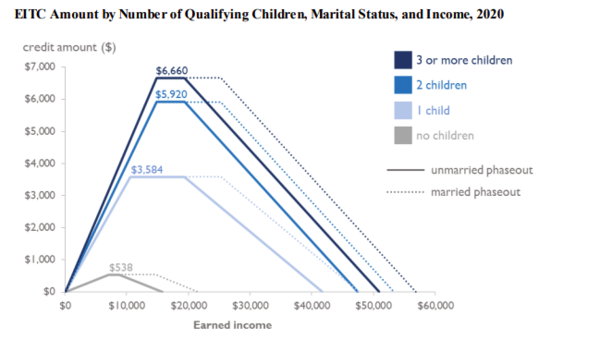

If you are claiming a federal earned income credit EIC enter the earned income you used to calculate your federal EIC. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. Earned income includes wages salaries tips.

Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of.

If you qualify you can use the credit to. Eligibility and credit amount depends on your income. SB 619 increases the value of Marylands Earned Income Tax Credit for workers who dont have children and non-custodial parents who arent claiming dependents on their taxes by increasing.

For wages and other income earned in. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years. 2020 may be eligible for tax credits based on the.

R allowed the bill to take effect without his signature. The maximum federal credit is 6728. Required to file a tax return.

2020 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit. 2020 Maryland Statutes Tax - General Title 10 - Income Tax Subtitle 9 - Tax Payment Part II - Payment of Tax Withheld Section 10-913. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. SB 717 increases access to the Maryland Earned Income Tax Credit for workers who dont have children and non-custodial parents who arent claiming dependents on their taxes. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return.

Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less. 2020 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit. Businesses and Self Employed.

2020 may be eligible for tax credits based on the. It is a special program for low and moderate-income persons who have been employed in the last tax year. The state EITC reduces the.

The program is administered by the Internal Revenue Service IRS and is a major anti.

Revised Maryland Individual Tax Forms Are Ready Maryland Association Of Cpas Macpa

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Earned Income Tax Credit Wikipedia

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

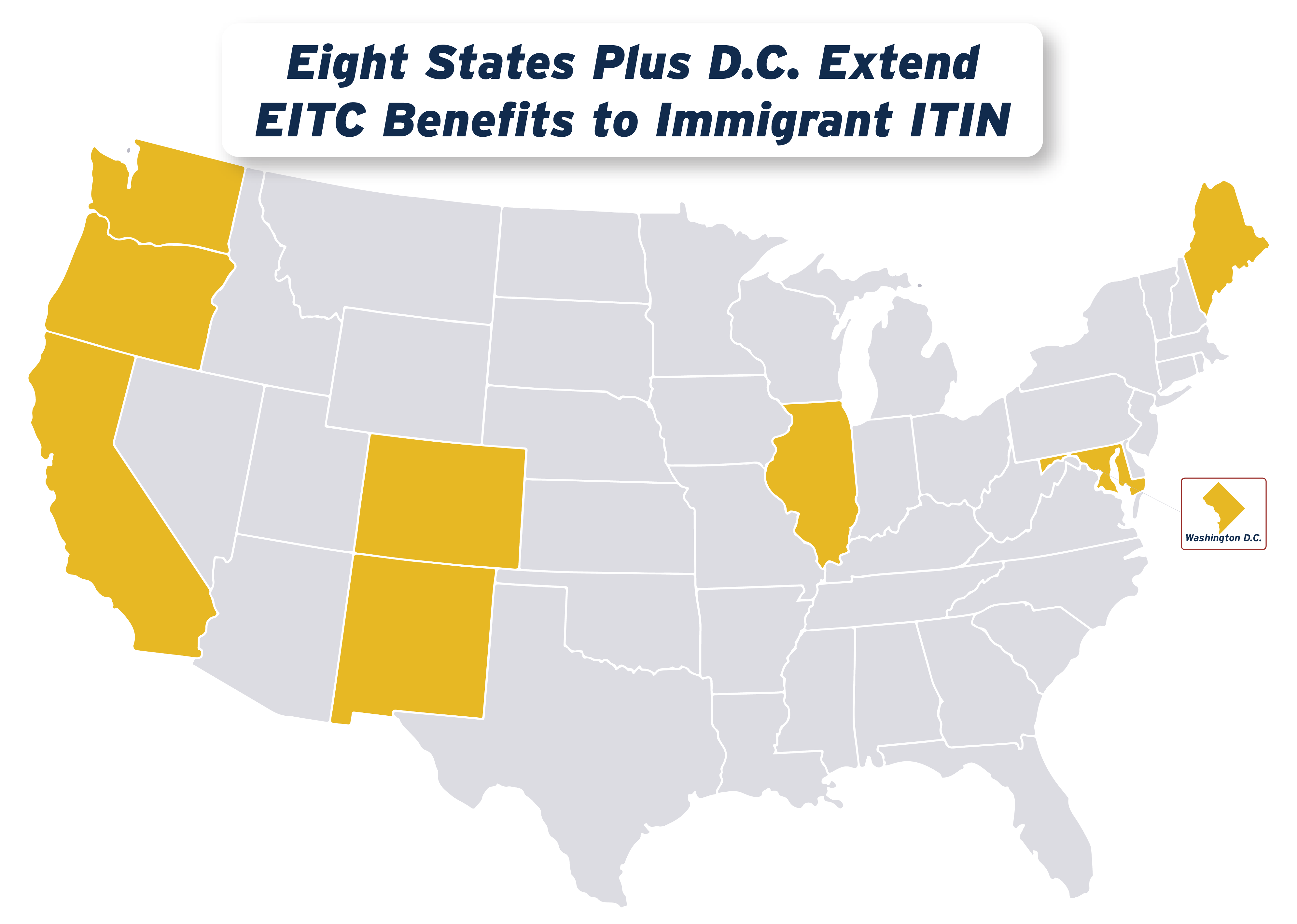

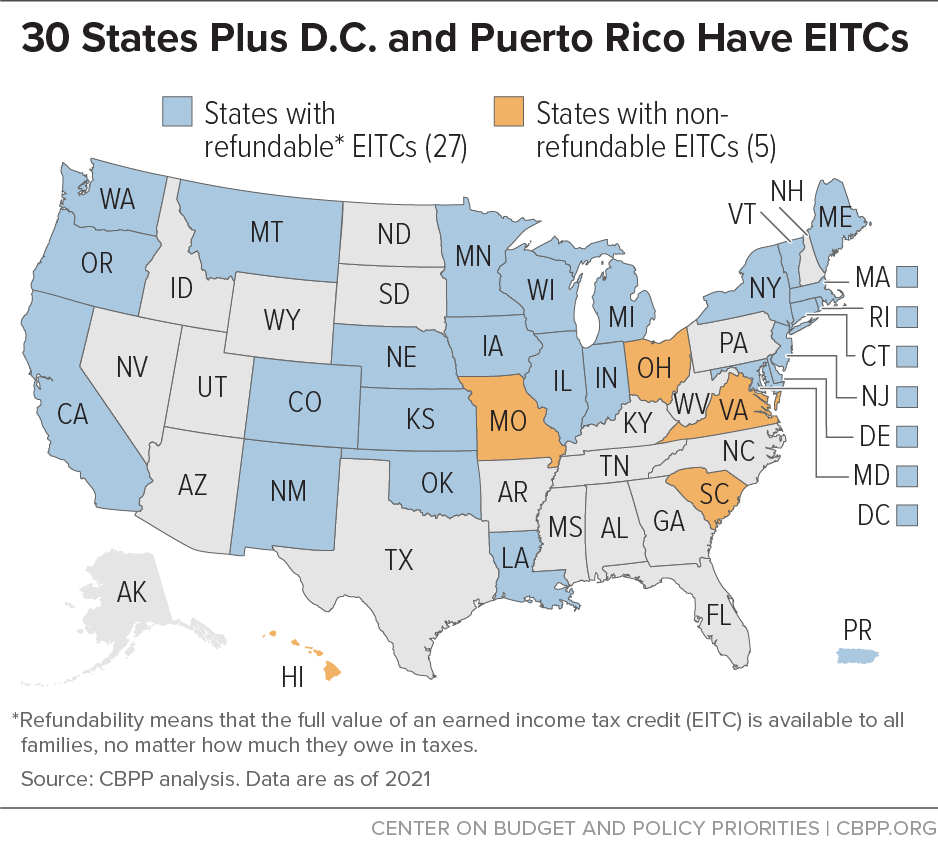

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

Tax Credits Deductions And Subtractions

Tax Credits Deductions And Subtractions

State Earned Income Tax Credits Urban Institute

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

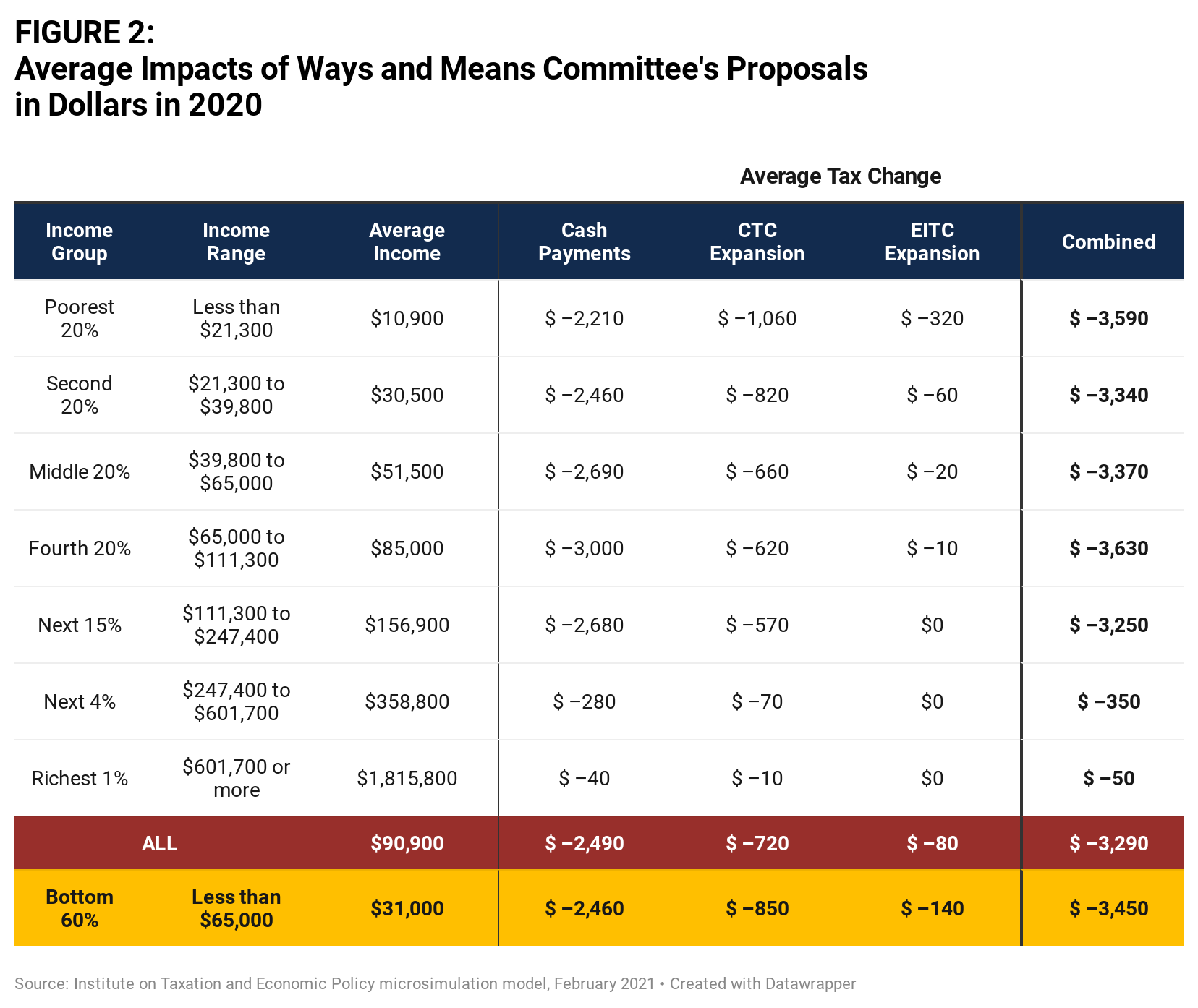

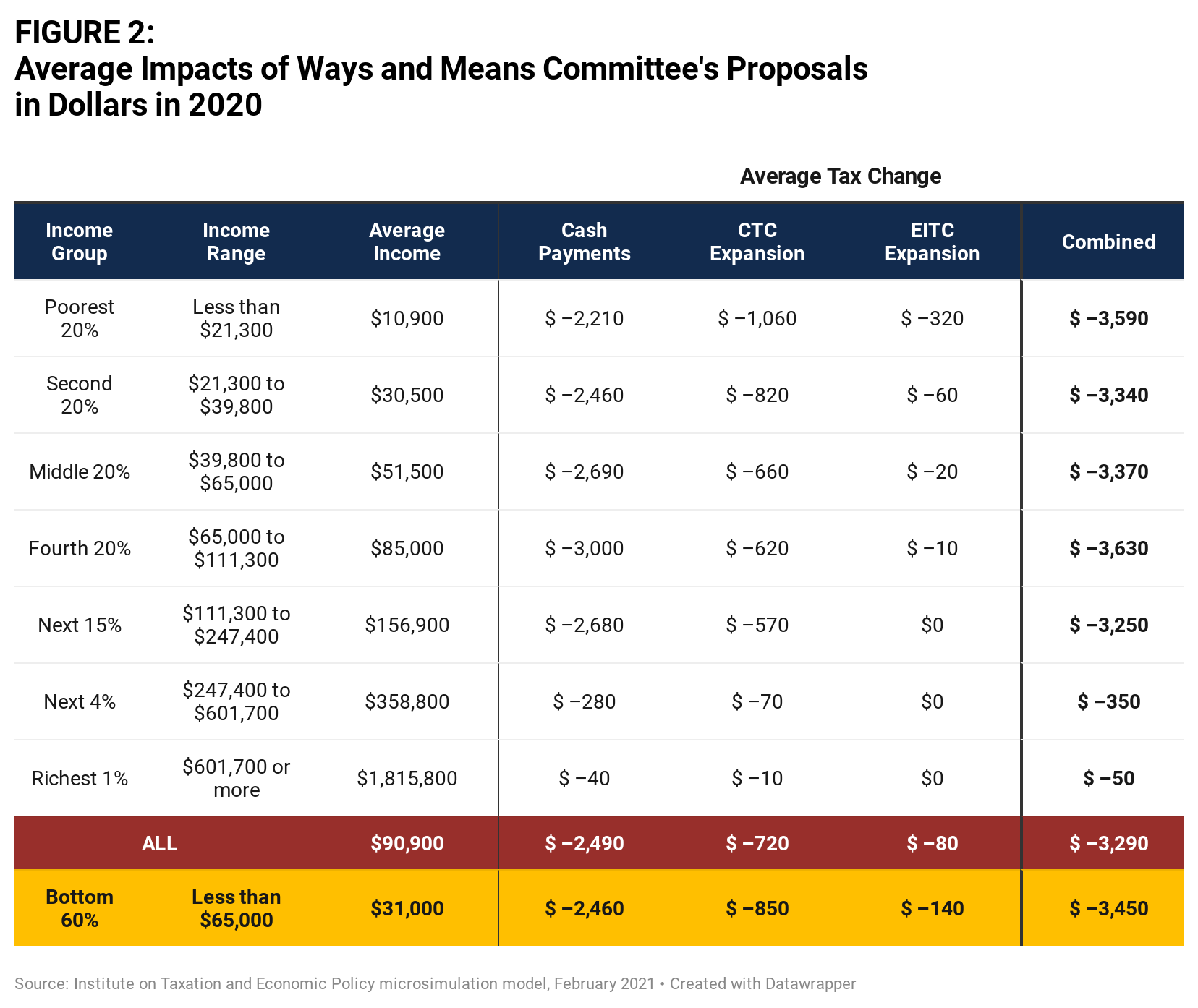

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Comptroller Of Maryland Tax Season News Conference Comptroller Franchot On Wednesday Morning Will Join Key Agency Personnel To Announce Major Changes For The 2022 Tax Season Designed To Help Maryland

Among New Maryland Laws Effective Monday Help For Parents Paying Thousands Of Dollars For Child Care Baltimore Sun

What Is The Earned Income Tax Credit Eitc Get It Back

9m In More Tax Credits Available For Maryland Student Loan Debt

Policy Basics State Earned Income Tax Credits Center On Budget And Policy Priorities

Earned Income Tax Credit Now Available To Seniors Without Dependents

The Effects Of State Earned Income Tax Credits On Mental Health And Health Behaviors A Quasi Experimental Study Sciencedirect

How Do State Earned Income Tax Credits Work Tax Policy Center